Quarterly Market Commentary - Summer Outlook

The following document provides Quarterly Market Commentary for the second quarter of 2020. This information is from FE Research.

Quarterly Market Commentary - Summer Outlook

Review of the past Quarter

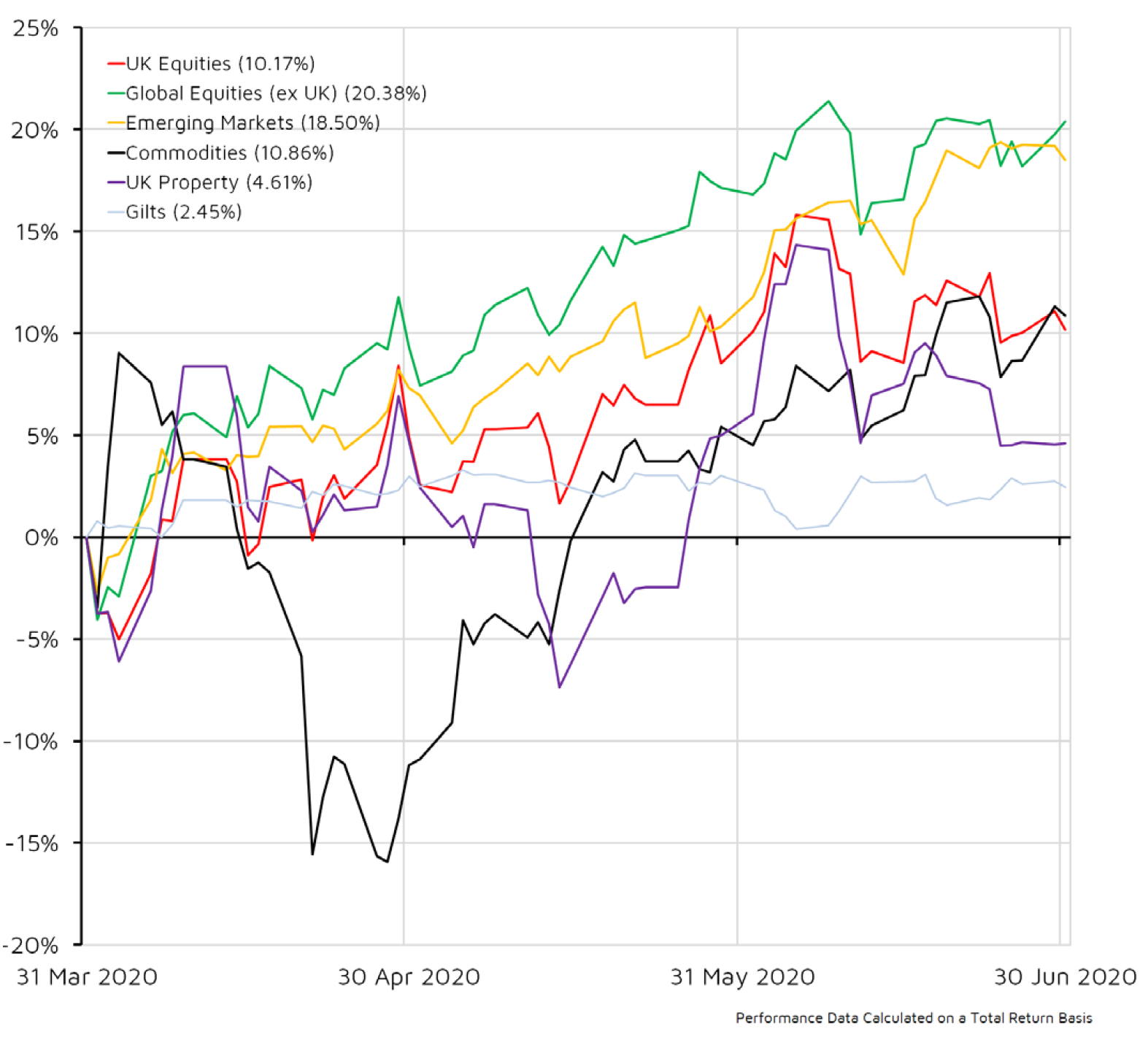

Financial markets recovered strongly after the sell-off in the first quarter of 2020. The recovery was led by US and emerging markets equities, but most asset classes produced strong returns after central banks and governments around the world stepped in to calm financial markets and provide financial support to businesses and workers unable to earn due to state sanctioned shutdowns.

The scale of government and central bank support has been far greater than anything seen in previous crises and has effectively put a floor under markets in the short term. The spread on corporate bonds has fallen back to more normal levels. US equities have seen some of the best performance due to the sharp increase in the value of its technology sector, while emerging markets have so far experienced less severe consequences of the economic shutdown.

Financial markets received further support as the quarter progressed, as countries gradually emerged from lockdown and some economic activity restarted. However, there have been bouts of volatility as markets appear nervous because of the speed of market recovery and that further outbreaks of coronavirus could bring further economic shutdown.

In a further sign of uncertainty amongst investors, government bond yields remain near historic lows, and although the value of the US dollar has fallen slightly over the quarter, the price of gold has continued to rise.

The actuarial view:

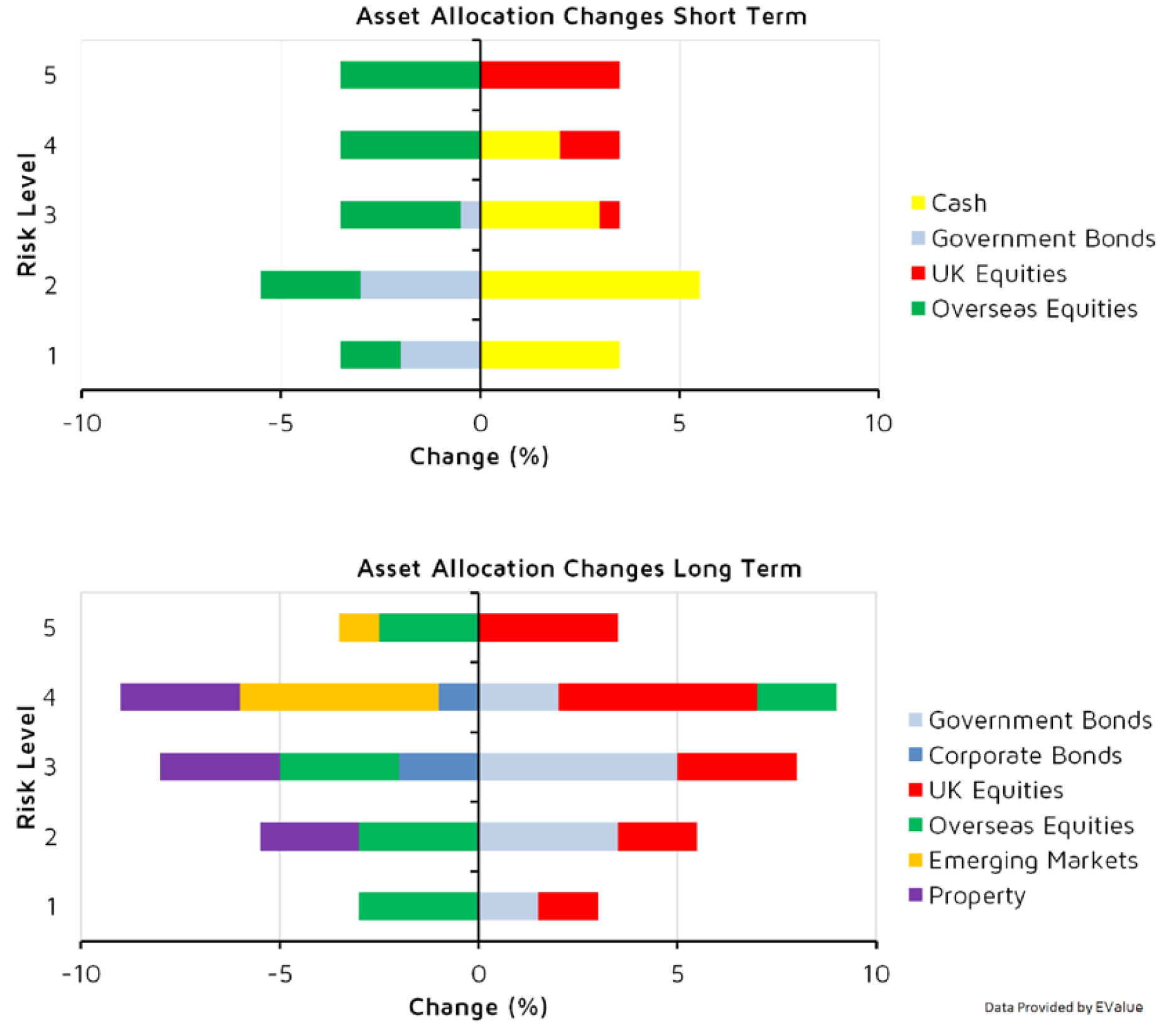

As might be expected, the outlook has worsened across the board. Japanese equities appear to have avoided the worst fall out, although questions over the country’s relatively low-key coronavirus interventions remain. UK equities are somewhat protected by UK sterling weakness, foreign earnings and a substantial repricing. Lower rates suppress fixed-income returns. Credit spreads blew up in March. They have since recovered a little, but the potential for defaults, further rating downgrades and liquidity panics remain, and expected returns have suffered more than government bonds. The outlook for property is pretty bleak over the next few months and, with significant probability, for some time after that.

The effect on short-term and, at low risk levels, medium-term allocations includes a shift to cash from bonds as at lower yields the asymmetric risk of bonds becomes less attractive. UK equities gain a little at the expense of overseas equities.

WHAT TO LOOK FOR IN THE NEXT QUARTER:

- UK: The Monetary Policy Committee (MPC) announcements and minutes are set to be released on 6 August. Preliminary GDP growth for Q2 is available on 12 August. Jobless claims change to be published on 16 July. The number of new daily coronavirus cases.

- US: There will be interest rate decisions from the Federal Open Market Committee (FOMC) on 28-29 July. Minutes will be published three weeks after each decision. GDP growth for Q2 to be released on 30 July. Change in Nonfarm Payrolls expected to be available on 7 August.

The number of new daily coronavirus cases. - Eurozone: Quarterly GDP flash data is set to published on 31 July. A European Central Bank monetary policy meeting has been arranged for 16 July. Unemployment rate for June set to be published on 30 July.

- Other Data: There will be an interest rate decision from the Bank of Japan on 15 July. JPMorgan Global Composite PMI is set to be published on 6 July and IHS Markit Global Business Outlook on 12 July. The International Energy Agency monthly report is due on 10 July.

ASSET CLASS SCENARIOS:

UK EQUITY

Most Likely: The gradual reopening of the economy combined with supportive fiscal and monetary measures should help UK equities to continue to claw back this year’s losses. If Brexit negotiations prove inconclusive, the UK may continue to underperform other markets and unemployment is likely to increase as government support is withdrawn. With the economy set for a period of weakness, the performance baton is unlikely to be handed over from growth to value stocks.

Worst Case: Easing lockdown too quickly could prompt a second wave of outbreaks and see restrictions reintroduced, keeping business in survival mode. Any negative surprise in stimulus, which has effectively backstopped the market, could hit confidence and see equities decline.

A lack of progress in Brexit talks could affect all equities and send UK sterling plummeting, adversely impacting domestically orientated smaller companies the most.

Best Case: The introduction of a working vaccine and good progress on Brexit negotiations will spark positive sentiment, removing the lid on performance and subsequently closing the premium gap compared to global peers. This scenario should see large caps lag due to UK sterling appreciation, but they too would benefit to a greater extent from reduced trade deal tensions.

CASH

Most Likely: The Bank of England has cut its interest rates to historic lows but is reluctant to go further, so returns from cash should stay at historically low levels. However, cash is likely to remain popular amongst market participants as volatility stays high. Central banks have also guaranteed the good functioning of those markets so money market funds will remain in demand for their liquidity features.

Worst Case: A T-shape recovery would be the worst case for cash, as investors would rush into risky assets. Real yields are at historic lows but a change in expectation for inflation will push cash returns even lower.

Best Case: A steady recovery would incentivise the Bank of England to bring its interest rate back to more normal territory, as it was at the beginning of the year. This would see the return from cash slightly improve while inflation is well contained. Market participants would also remain more cautious in taking risk back, such that demand for cash and liquidity stays high.

GLOBAL EQUITY

Most Likely: Covid-19 continues to impact economic activity but markets have rebounded, with investors focusing on central banks and governments’ supportive measures. A sustained period of low inflation and rates could allow equities to make further gains; but the full impact of the coronavirus will only be discovered over the coming months. The International Monetary Fund substantially lowered its global growth forecast for 2020, predicting a decline of almost 5 per cent.

Worst Case: As lockdown conditions have eased markets are vulnerable to negative news surrounding a potential second spike. The November US election will likely bring some volatility as Donald Trump continues to polarise voters. His response to Black Lives Matter protests and coronavirus has provided Democratic candidate Joe Biden with a notable lead in the polls.

Best Case: Markets seem to be priced for an optimistic outcome, but if we see a broad second wave of global infections, investors could be in for a shock. Stimulus provided by central banks and governments continues to support equities. If we don’t see a second spike in the coming months this positive sentiment is likely to be here to stay, at least for the short term.

EMERGING MARKET EQUITY

Most Likely: Emerging markets should rebound but the threat of virus resurgence weighs on the outlook, with the deepest scars from the pandemic likely to be inflicted in Latin America. A weakening US dollar since March has so far been beneficial to emerging markets, but unless there is a significant upgrade in global growth expectations, which seems unlikely, emerging markets could continue to underperform relative to developed markets.

Worst Case: Large parts of the emerging market universe have still not got the coronavirus under control – Brazil is now the epicentre while India and Russia are facing material challenges. The risk of a second wave of Covid-19 infections, particularly in north Asia, could halt the mini-bull market. Also, little attention has been paid to US-China trade uncertainty, which can quickly turn sentiment negative.

Best Case: There is already a lot of optimism priced in markets, driven by central bank easing rather than earnings or actual economic data. If economic data lives up to or beats expectations, markets could remain high. A rebound in the services sector, improving employment and rising overseas demand could be key catalysts.

FIXED INCOME

Most Likely: We expect volatility to stay high in fixed-income markets as risk of a second wave of Covid-19 and geopolitical risk remains. Central banks remain in the driving seat and remain committedto keeping low yields for longer. Corporate bond markets will continue to benefit from the strong technical tailwinds of central bank purchases and ongoing demand for income, while companies are restoring their balance sheets.

Worst Case: Credit markets may have moved too far in pricing a more constructive outlook ahead, while governments and central banks have used their full power. A second wave of Covid-19, escalating US-China tensions and concerns around the US election could lead to a more uneven recovery and stoke volatility that roils markets.

Best Case: The momentum in risky assets suggests further gains could be achieved if policy success leads to incremental improvements in activity and corporate earnings. The central banks maintain their control over yield curves such so there is no danger in holding interest rates sensitive instruments.

PROPERTY

Most Likely: The short-term remains unpredictable given the global variations in the spread of the coronavirus. Even if there are second or third waves, it is likely subsequent lockdowns will not be as severe as the initial one. Some property companies have adjusted by adapting properties and ensuring rent is affordable. Some will even benefit (such as logistics and data centres); however, for areas that were already in distress there is the very real risk of bankruptcies, particularly in the retail sector.

Worst Case: The withdrawal of government economic support is followed by widespread job losses and reluctant consumers, which hampers recovery. The latter part of the summer across Europe and the US is an important time for economic activity and if this is missed it could lead to widespread economic pain, resulting in a prolonged recession and commercial tenants not paying rents.

Best Case: The spread of Covid-19 continues to slow. Extra easing and fiscal spending revive the economy without causing inflation, and low interest rates continue to make real estate investment attractive. Companies will welcome the stopping of rent holidays and only have to take a small downgrade on rental income received.

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN