Quarterly Market Commentary - Winter Outlook

The following article provides Quarterly Market Commentary for the first quarter of 2021. This information is from FE Research.

Quarterly Market Commentary - Winter Outlook

Review of the past quarter

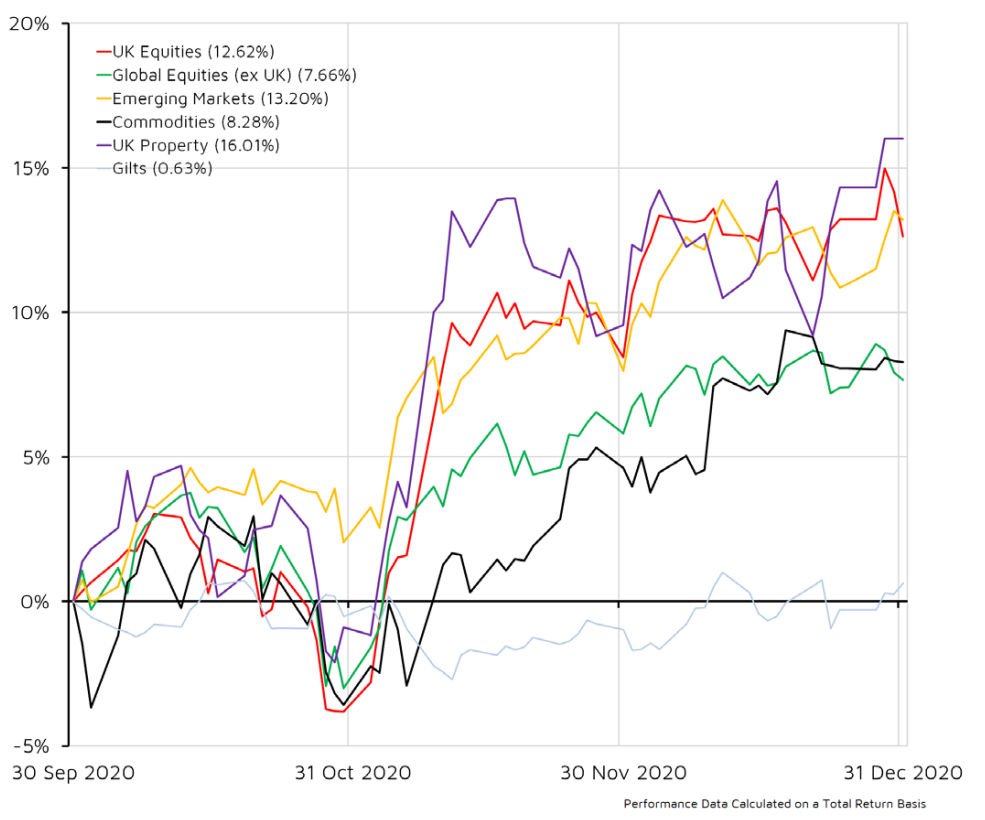

The quarter started with markets caught between optimism about potential vaccines and pessimism about the second wave of coronavirus infections. News of successful vaccine trials in early November saw investors rush to risk assets and many equity markets saw their best ever monthly returns. US markets were reassured by the prospect of political stalemate in Washington, as Joe Biden’s victory in the presidential election was balanced by the Republicans likely retaining control of the Senate.

The UK produced very strong equity returns as financial services, energy production, and miners - companies that do well in periods of economic growth – benefitted from hopes of faster economic recovery. These gains were delivered despite the lack of progress in UK/EU trade negotiations.Most other equity markets performed well in the last quarter of 2020, although the rotation from growth companies into value stocks saw US technology stocks, the standout performers of 2020, underperform in the final weeks of the year.

Corporate bonds continued to produce positive returns. Bonds with the highest yields saw the strongest performance as investors continue to seek higher returns. Defensive assets, including gilts, gold and the US dollar, fell in value as investors moved money into assets with greater potential for growth.

The actuarial view:

In current circumstances conventional economic indicators are hard to interpret. Filling the gap left by the ritual scrutiny of growth and employment statistics has been talk of which letter the recovery will look like. Will the impact be permanent, making the recovery look like an L? Will there be a gap before resumption of normal service making the crisis look like a U? Or, will things bounce back to draw a V? So far, the answer seems to be the backwards square root symbol: a rapid but only partial recovery. With the challenges ahead, this could easily be just the first part of a W, with another dip on the way.

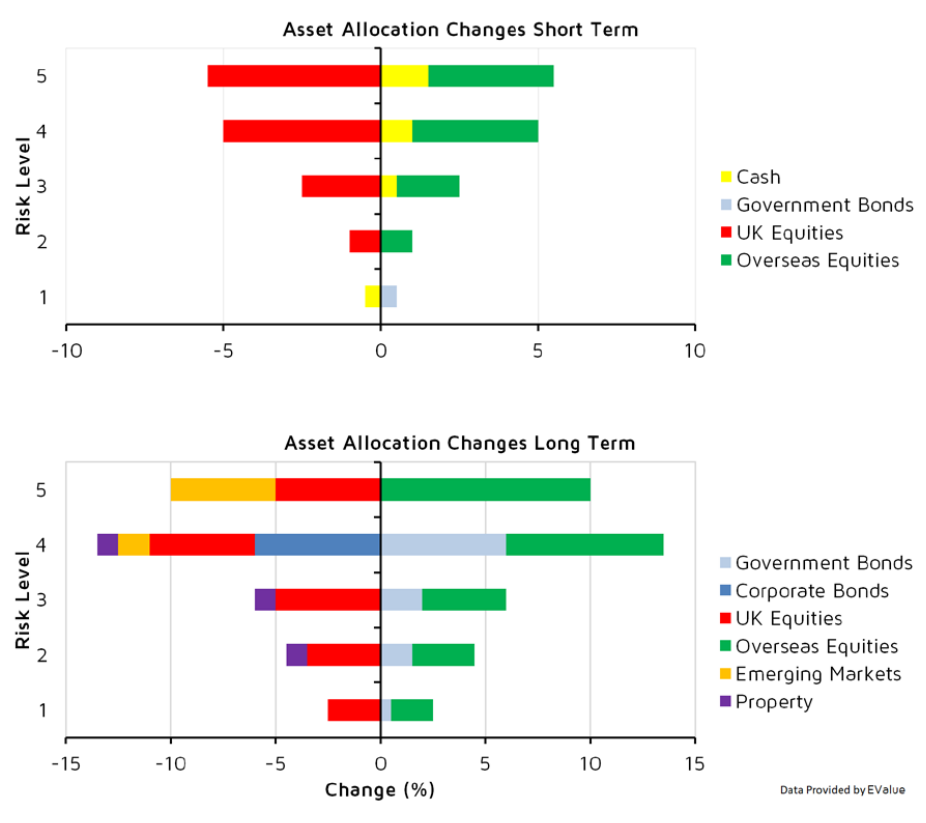

In general, changes in outlook were pretty small and relative movements were dominated by a declining outlook for UK businesses. In equities, in general, share price rises more than offset any improvement in underlying outlook. The outlook for UK corporate bonds suffered from the same drags as UK equities. The outlook for property continues to worsen, with dire current conditions not offset by weak growth expectations for the future. The relative attractions of other markets barely shifted and should not be over-interpreted.

WHAT TO LOOK FOR IN THE NEXT QUARTER:

- UK: The UK’s transitional arrangement with the EU ends on 31 December 2020. The Monetary Policy Committee (MPC) announcements and minutes are set to be released on 4 February and 18 March. Preliminary GDP growth for Q4 2020 information will be available on 10 February. Labour market overview to be published on 26 January. Number of new daily coronavirus cases.

- US: Georgia Senate runoff elections 5 January. There will be interest rate decisions from the Federal Open Market Committee (FOMC) on 26-27 January and 16-17 March. Minutes will be published three weeks after each decision. GDP growth for Q4 2020 to be released on 28 January.

- Eurozone: Quarterly GDP flash data is set to published on 2 February. European Central Bank monetary policy meetings scheduled for 21 January and 11 March. Unemployment rate set to be published on 8 January.

- Other Data: Caixin China General Manufacturing PMI is due on 4 January and the JPMorgan Global Composite PMI on 6 January.

ASSET CLASS SCENARIOS:

UK EQUITY

Most Likely: Following the last-minute Brexit deal and with the Covid-19 vaccination program ramping up, we expect economic uncertainty to progressively fall, benefiting UK equity prices and sterling. Large scale monetary and fiscal support will help protect companies’ balance sheets and support recovery. Smaller companies should experience the best relative performance, however, volatility will remain.

Worst Case: Covid-19 can still surprise negatively, as proved by the emergence of the new virus strain in December, and the only available remedy for governments is limiting people’s mobility. If tier four restrictions are broadly extended and the rollout of the vaccine faces setbacks we will see additional damage to UK equities and sterling.

Best Case: If the vaccination program goes well and post-Brexit interactions with the EU progress smoothly, we could see an easing of restrictions and acceleration of recovery. After months of suppressed demand and increased savings, consumers would try to catch up and boost consumption. The improved outlook could also reverse recent fund outflows creating positive momentum for UK equities. Smaller

companies would be the largest beneficiaries, while large caps could see tailwind from increased global demand of oil and basic materials.

CASH

Most Likely: The Bank of England has cut its interest rates to historic lows but is now contemplating a negative-rate policy. Expectations have therefore worsened for cash investors. However, cash is likely to remain popular amongst market participants as volatility stays high. Money market funds will remain in demand for their liquidity features.

Worst Case: Although investors only expect the Bank of England to discuss negative rates, a move to negative rates can happen and penalise savings accounts. The return from money market funds will turn negative, forcing investors into less liquid and riskier assets.

Best Case: A strong recovery would incentivise the Bank of England to maintain interest rates at current levels. It is also likely that the interest rate curve will steepen, in expectation of future interest rate increases, which would slightly improve the return from money market funds, as managers can lock higher rates at longer maturity dates.

GLOBAL EQUITY

Most Likely: A runoff election in Georgia in January will determine control of the US Senate. It is difficult to predict whether cyclical stocks will continue their recent outperformance, but recent market moves reflect a sharp divergence from reality, with Covid-19 cases rising globally. The persistence of the cyclical rotation could depend on how quickly vaccines can be distributed and how quickly economies rebound.

Worst Case: The boost to equity markets from coronavirus vaccines could reverse if governments do not approve them or there are delays in distribution. If the Democrats win both seats in the US Senate, Biden would be able to push his agenda of higher taxes and antitrust enforcement, which could be negative for markets.

Best Case: The market has seen a sharp rebound in the areas hit hardest by the virus but a further rerating is possible if these companies deliver on earnings and economies rebound faster than expected. If the Republicans maintain their majority in the US Senate, Joe Biden will struggle to push his agenda of higher taxes and antitrust enforcement, leading to a more favourable market outcome.

EMERGING MARKET EQUITY

Most Likely: Successful coronavirus vaccines, and their positive impact on global growth, should see emerging markets to continue their rebound, and even outperform their developed market peers. The areas hit hardest by the pandemic, such as Latin America, stand to gain the most. However, there will still be parts of the economy with lasting damage done, so don’t expect a smooth ride upwards.

Worst Case: Delays in vaccine production and rollout in the developed world will negatively impact global growth expectations and could spill over into emerging markets, meaning they must wait longer to get the virus under control. India, Russia and Brazil are some of the worst affected countries and, with debt piling up, could be vulnerable to a strengthening US dollar if it picks up after recent weakness.

Best Case: The rollout of vaccines in developed markets quickly followed by distribution in emerging markets, especially approval of one of the vaccines that is easier to transport than the Pfizer one, will reinforce the market’s recent positive reaction. Continued good economic data backed up by continuing easy monetary policy makes sovereign debt loads manageable and will lead emerging markets to outperform.

FIXED INCOME

Most Likely: Central bank policy remains accommodative with no indication that policy will be tightened during 2021. With credit spreads already at historically low levels there is limited room for a further increase in valuations, but corporate bond managers deliver steady returns driven by coupon income.

Worst Case: Developed governments discover major obstacles to the planned smooth and speedy roll out of vaccines. As a result, default expectations for high yield bonds pick up and investors sell out of assets with higher credit risk in anticipation that some companies will struggle to survive economic lockdown through the full year.

Best Case: Other policy makers follow the European Central Bank’s lead by announcing a significant increase to the size and pace of their asset purchase programmes. Combined with the effective distribution of vaccines, this ensures the bonds of companies worst impacted by the pandemic rally to late 2019 valuations.

PROPERTY

Most Likely: Even if the global economy recovers strongly, it is expected that real estate will lag other risk assets. Current market trends are expected to continue, with high quality offices and data centres continuing to outperform physical retail and leisure industry assets. The UK property market is also expected to lag developed peers due to the Brexit risk and the end of the stamp duty relief.

Worst Case: Despite developed countries rolling out their vaccination programmes, developed economies are not expected to strongly recover as restrictions remain in place. The outlook for real estate remains highly uncertain, with property companies in need of additional capital.

Best Case: The new approach to containing the coronavirus proves effective at vaccinating the vulnerable whilst letting most of the working population to continue to move freely. A surge in inflation would also help house prices to likewise surge.

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN