Quarterly Market Commentary - Summer Outlook

The following article provides Quarterly Market Commentary for the third quarter of 2021. This information is from FE Research.

Quarterly Market Commentary - Summer Outlook

Review of the past quarter

Inflation, or the fear of inflation, has been a running theme in financial markets in 2021. As Covid is brought under control in many developed economies, helped by successful vaccination programmes, the easing of Covid-19 restrictions has seen many economies recovery strongly. The return of consumer spending, as well as the ‘base effect’ of artificially low prices this time last year due to lockdown, has driven up some inflation measures quite sharply and caused some volatility in financial markets.Higher inflation increases the chances of central banks having to raise interest rates, which in turn reduces demand for government bonds and higher-growth equities, while boosting demand for equities likely to benefit from economic growth, such as financial services and energy companies.

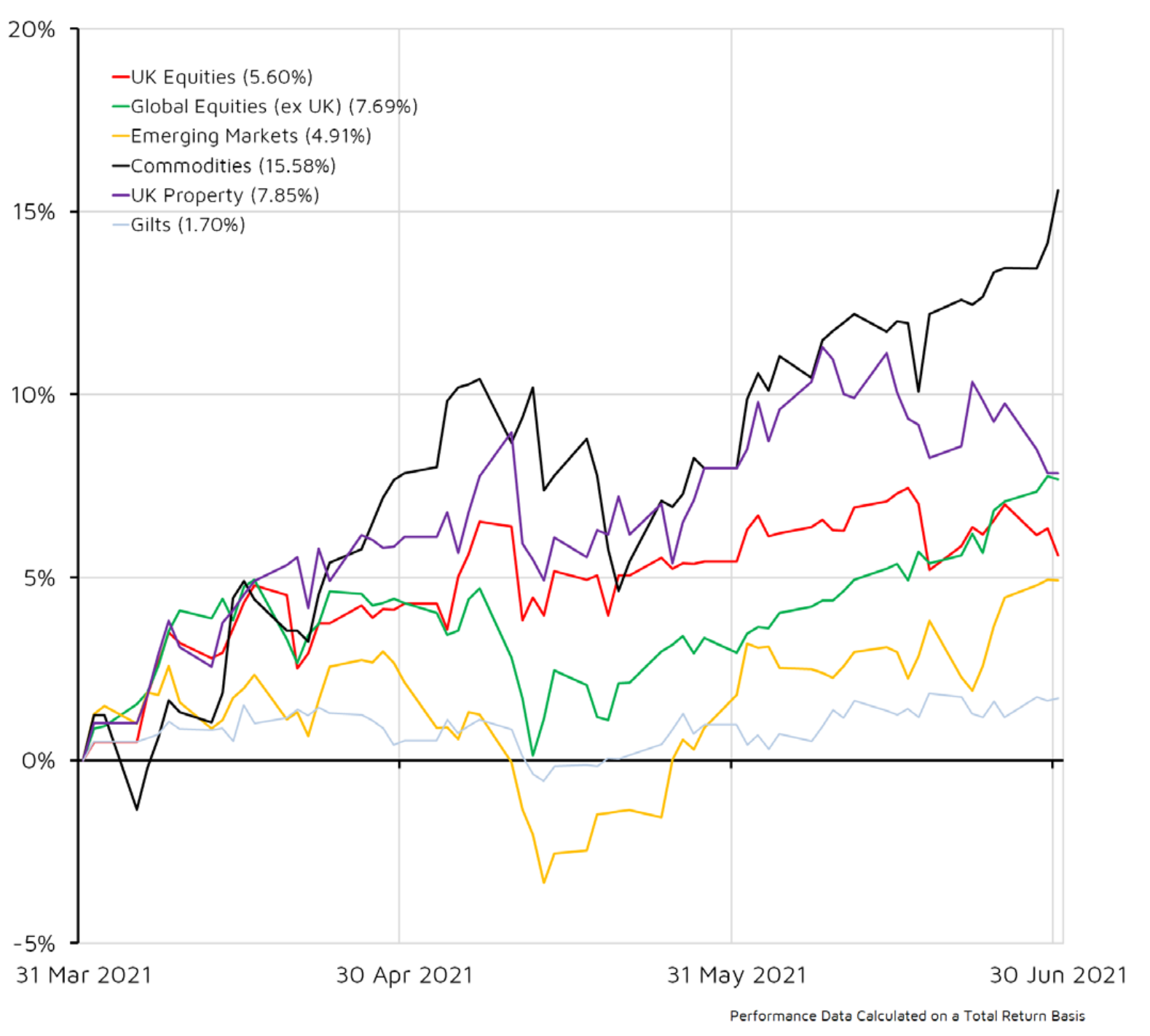

Despite periodic outbreaks of inflation worries, gilts have remained quite stable and they produced a positive return over the last three months. Equities proved more volatile but, with the exception of Japan, produced strong returns. On the whole, the recent trend for smaller companies to outperform large ones continued, with UK smaller companies producing some the largest gains. However, UK equities slightly underperformed other developed markets.

The strongest returns this quarter came from commodities as the return to global growth increased demand for oil and other raw materials. Property also produced strong returns as the removal of coronavirus restrictions helped claw back some of the losses from 2020.

The actuarial view:

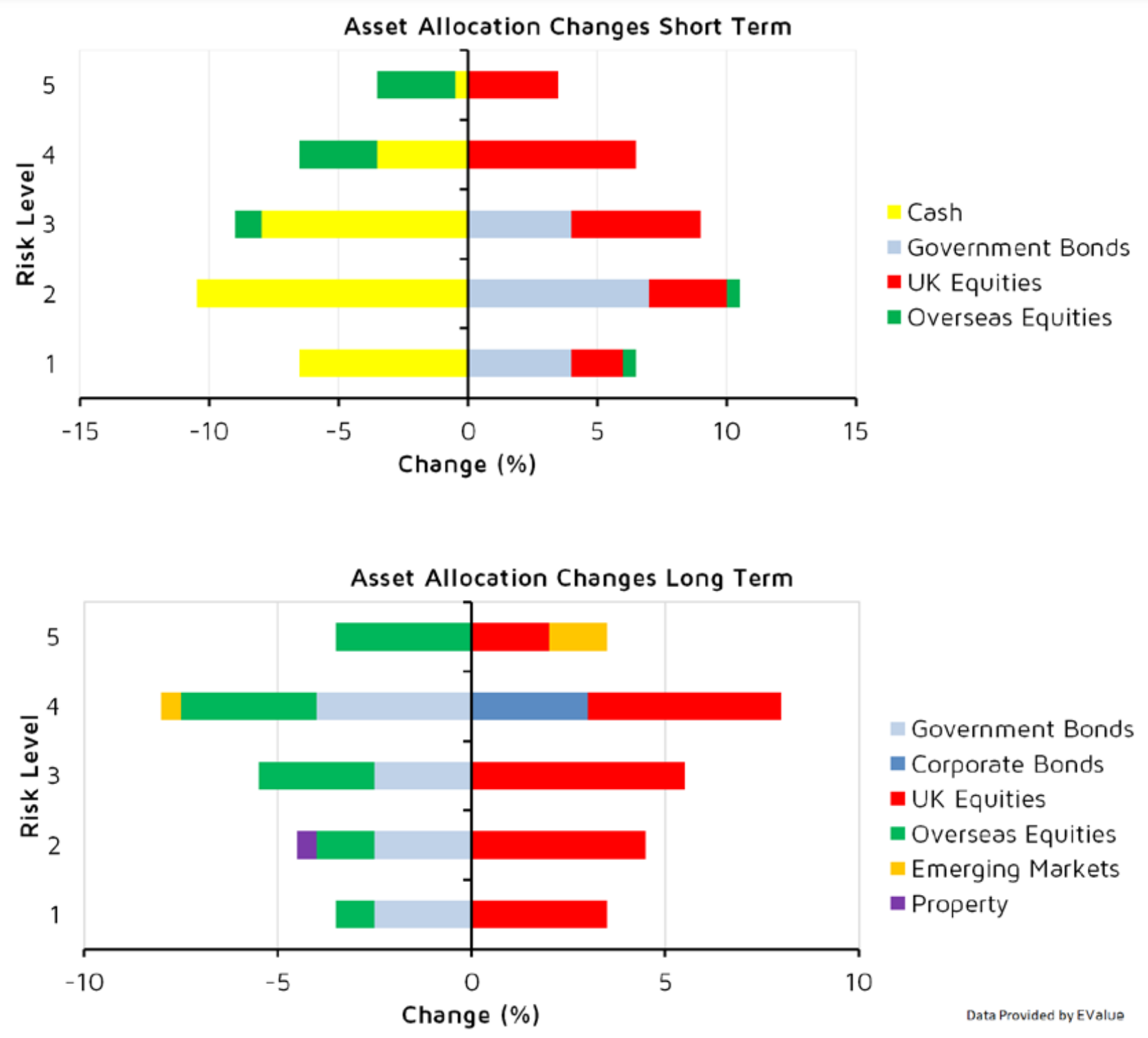

Working out what economic indicators really mean is difficult. There are clues everywhere but they may not mean what they would in more normal times and they are mixed in with at least as many red herrings. Much of what happens next is in the hands of governments and central banks, and as such is vulnerable to mistakes and losing bets.Rising interest rates mean higher yields from bonds and less asymmetrical risks. Higher long-term interest rates mean higher long-term expectations for cash – but

short-term rates have not yet moved, so the outlook for cash has risen by only a relatively small amount in the short term.

Rising rates and equity prices reflect rising growth expectations. For overseas equities, developed and emerging, the improvement is modest. For UK equities,

some uncertainty about the ability of UK companies to make it through Brexit and the coronavirus crisis has been resolved and the result is a relatively strong showing for UK equities. Property prospects have recovered as the long-term outlook has improved.

WHAT TO LOOK FOR IN THE NEXT QUARTER:

- UK: The Monetary Policy Committee (MPC) announcements and minutes are set to be released on 6 August. June inflation reading is out on 14 July. Employment data for May will be published on 15 July. Preliminary GDP growth for Q2 is available on 12 August. Number of new daily coronavirus cases.

- US: There will be interest rate decisions from the Federal Open Market Committee (FOMC) on 27-28 July. Minutes will be published three weeks after the decision. GDP growth for Q2 to be released on 29 July. Change in Nonfarm Payrolls will be out on 2 July. Monthly consumer inflation will be published on 13 July. Number of new daily coronavirus cases.

- Eurozone: A European Central Bank monetary policy meeting has been arranged for 22 July. Update on June inflation will be released on 16 July. The unemployment rate for June is set to be published on 30 July and the quarterly GDP flash data for Q2 is set to published on 31 July.

- Other Data: JPMorgan Global Composite PMI will be out on 6 July. Chinese Q2 GDP growth and retail sales updates are due on 14 July. Bank of Japan interest rate decision will be published on 15 July.

ASSET CLASS SCENARIOS:

UK EQUITY

Most Likely: The delay in fully reopening the economy proves temporary and the relaxation of restrictions and smooth roll-out of vaccines continues over the summer. Rising consumption and positive domestic sentiment should prove supportive of UK sterling – assisting smaller companies the most. Inflation is expected to rise, although not fast enough drive up interest rates in the short term.

Worst Case: Rising cases or new vaccine-resistant mutations could trigger a return to tighter restrictions, with effects felt most by small and mid-caps. Conversely, stronger than expected demand fromreopening economies could trigger a sharp rise in inflation, which may prompt interest rate hikes as central banks become more hawkish – which could prove painful for equities as a whole.

Best Case: The recent delay to lockdown easing is shorter than expected with no return to tighter restrictions. This could boost consumer spending, resulting in a faster recovery, which would be most favourable to small and mid-caps. A weaker US dollar will provide a further lift to UK large-cap equities. The release of pent-up demand could also help protect jobs when furlough is rolled back.

CASH

Most Likely: The chance of the Bank of England further cutting its base rate has disappeared, helped by the success of the vaccination programme. Yields available for money market instruments remain low as the Bank has no intention to hike its interest rates in the immediate future. The outlook for cash investors has worsened as the market expects inflation to pick up in the coming quarter. However, cash remains compelling for investors who are concerned about volatility remaining high.

Worst Case: Although there is almost zero probability for the Bank to explore negative interest rates, the delay in lifting all restrictions means yields for money markets are anchored to very low levels. Any further delay to reopening might force investors to reassess yields to lower levels, lowering the returns expected from money market instruments.

Best Case: If inflation rises above expectations, the Bank may contemplate increasing rates over the coming year. It is also likely that the interest rate curve will steepen, which would slightly improve the return from money market funds, as managers can lock higher rates at longer maturity dates.

GLOBAL EQUITY

Most Likely: Corporate earnings are recovering, led strongly by the US. Overall, global equity markets should benefit from the reopening of economies, as both revenues and profits are expected to grow strongly. Inflation concerns are likely to linger, where the tech-heavy US market could underperform relative to Europe ex-UK and Japan.

Worst Case: US earnings expectations have been skyrocketing so any disappointment could be an unwelcome negative surprise. If the market expects inflation to inch higher or central banks signal their willingness to tighten earlier than the market expects, global equities could suffer sharp falls. While the Japanese government has decided to press ahead with the Olympics, the tourism sector is set to suffer as international spectators have been banned.

Best Case: Global equities should continue to benefit as the global economy reopens. Economic activity remains strong across both manufacturing and service businesses. Among regions, Japan could benefit the most as corporate earnings have a close link to the health of the global economy. The vaccination rollout in Europe ex-UK got off to a slow start but has accelerated and should provide a much-needed boost to service sectors.

EMERGING MARKET EQUITY

Most Likely: The global recovery and improving investor sentiment is shifting assets away from typical ‘safe havens’, such as the US, to riskier assets such as emerging markets. This puts downward pressure on the US dollar and strengthens emerging market currencies, exports and future growth expectations. China has started to restrict fiscal and monetary policies to prevent economy overheating. Although this a prudent move in the long-term, this will inevitably dampen Chinese economic growth in the short to medium term.

Worst Case: A lengthy delay in setting up effective vaccination programmes could hinder the global recovery. If the US Federal Reserve raises interest rates this could make the US economy more attractive to investors, providing support for the US dollar. A large majority of emerging market company debt is denominated in US dollars so any appreciation would make these loans more expensive.

Best Case: Vaccinations remain on track – coupled with limited future additional waves of Covid-19, this will prove supportive for a broadbased economic recovery. Low interest rates in the US will continue to attract flows to regions such as emerging markets. The implementation of stimulus packages from many economies will benefit emerging markets via strong commodity demand and pricing.

FIXED INCOME

Most Likely: Inflation continues to run at slightly higher levels through the summer but the Bank of England remains committed to its plan to buy £875 billion of government bonds purchase this year, which should keep a lid on government bond yields. The environment for corporate bonds continues to improve but, with borrowing costs already at historic lows, appreciation in bond valuations is limited.

Worst Case: Central banks mismanage the tapering of government bond purchases and surprise the market by indicating they will slow significantly this year. This sudden removal of support causes a selloff in government bonds, which sees yields take a significant rise. The policy shock also damages appetite for risk, assets and corporate bond valuations fall as investors demand more compensation for credit risk.

Best Case: More signs emerge that recent inflation will be transitory and investors shrug off any high inflation readings as clear signals are offered that monetary policy will not be tightened until at least late 2022, which helps to push government bond valuations higher. The global economic outlook improves as vaccine distribution quickens, increasing demand for higher yielding bonds, which surge further in value.

PROPERTY

Most Likely: Real estate companies should benefit from a rebound in rents and occupancy rates as the vaccine roll-out continues and lockdown restrictions are eased. However, potential upside in the sector may be limited given current valuation levels as the market has largely priced in a recovery in cyclical areas of the market, particularly in regions that have been further ahead in their economic turnaround.

Worst Case: An increase in Covid-19 cases causes a delay to economic reopening and recovery and causes real-estate shares to trade lower. This is particularly the case for sub-sectors that have become richly valued despite having been impacted the hardest, such as retail and hotels. Covid-19 disruption prevents a return to offices and resumption of international travel.

Best Case: Improving fundamentals, and continued investor interest in cyclical areas of the market as the global economy recovers, makes a bullish case for real estate. In addition, if government bond yields remain stable or fall, property shares will be attractively priced on a relative yield basis.

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN