Q1 2022 Market Update

The start of 2022 has seen increased volatility in financial markets. This article outlines some of the reasons why, and what the future might hold.

Q1 2022 Market Update

As we enter the third year of a global pandemic, markets have been very volatile since the start of 2022. The purpose of this article is to explain what some of the driving forces have been and what this could mean for your portfolio.

Whilst 2020 saw the world quickly adapting to ever changing circumstances, 2021 saw many COVID-19 restrictions start to be lifted and companies and economies started to recover strongly. US unemployment levels fell to pre-pandemic levels and economic growth turned positive by the third quarter of 2021. This provided positive returns for many stock markets through 2021.

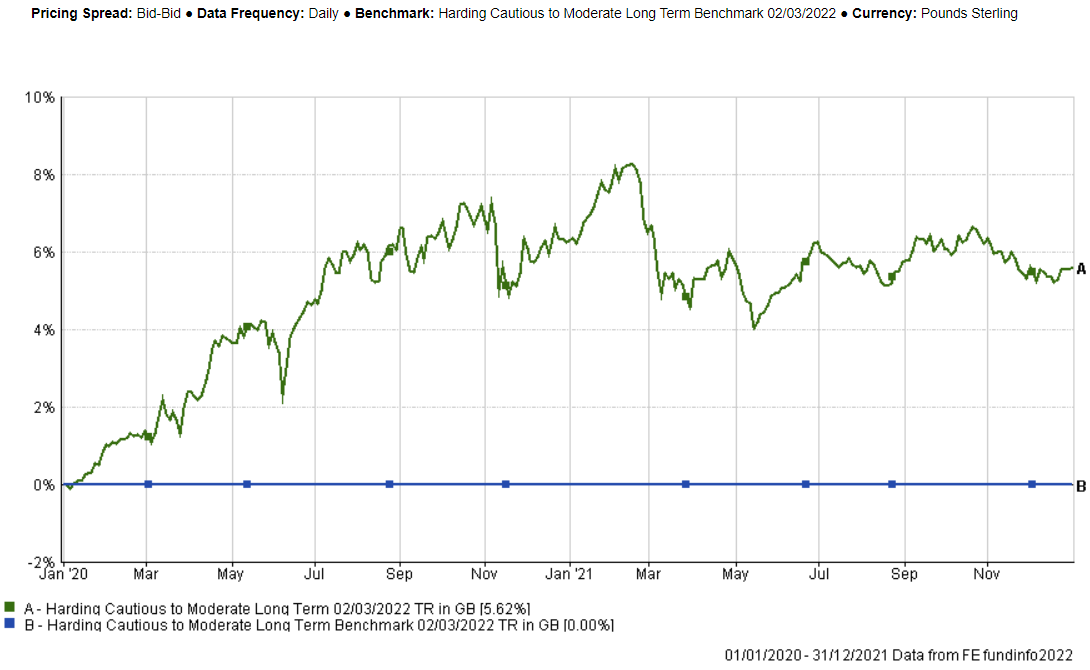

Specifically at Harding, due to our tactical decisions and overseas company investments, we saw outperformance of our portfolios against the majority of our benchmarks in 2020 and 2021. The graph below shows the performance of our Cautious to Moderate long-term portfolio through 2020 and 2021 relative to the 'sector weighted average' benchmark.

As you can see in the chart below, this particular portfolio outperformed by 5.62% over this two year period, net of charges.

However, with the recovery from the global pandemic, other impacts have emerged. With the global lockdowns, the cost of importing goods increased and therefore inflation increased dramatically towards the end of 2021, which has continued in the early months of 2022.

Whilst it was originally anticipated that the inflation spike would be short lived as COVID-19 becomes less disruptive to our lives, many believe that inflation could now be here for quite a while longer. This has resulted in the US Federal Reserve (Central Bank) looking to potentially raise interest rates in the US up to 7 times in 2022, in order to help curb inflation.

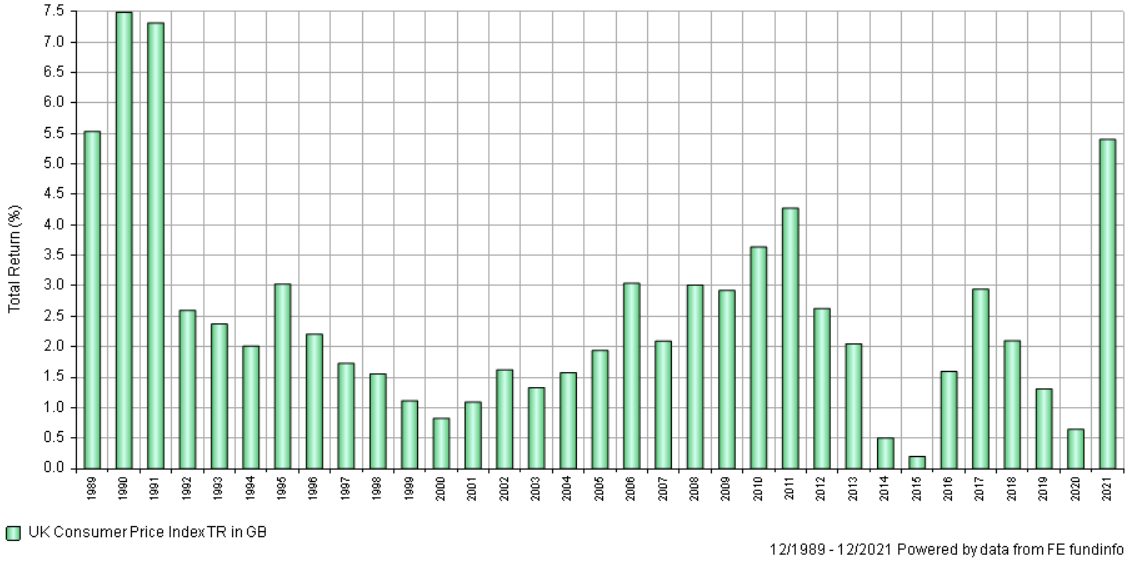

The graph below shows the annual UK Consumer Price Index (CPI) measure of inflation since 1989. As you can see from the chart below, the annual CPI figure for 2021 was just short of 5.5%. This is the highest figure since 1991.

This annual figure of 5.5% is despite Q1 2021 contributing less than a 0.2% increase in inflation. Therefore, this figure is effectively a combination of only the last three quarters of the year.

The concern about continued inflation has been exacerbated by the Russian invasion of Ukraine. With the sanctions that have been applied on Russia, not only is this resulting in higher oil and gas prices, this is also having an effect on higher commodity prices, with Russia and Ukraine being a major producer of food and agricultural products.

Why is inflation important?

Whilst inflation is a direct measure of household costs and therefore high inflation means that our cost of living increases, it also means that the cost of goods for companies increases. With increased costs of goods, company profitability reduces, and prices for consumers inevitably rise.

It also has a significant impact on another key sector within the financial markets, which is the technology sector.

Technology companies typically hold a lot of money in cash. For example, Apple currently holds approximately $202.6Bn in cash1. Whilst this may sound very appealing, inflation erodes the buying power of that cash, and if inflation increases, it erodes the true value of the cash holding. Therefore, with inflation rising, the valuation of companies that hold a large amount of cash potentially reduces, despite the fundamental profitability of the company's activities not changing.

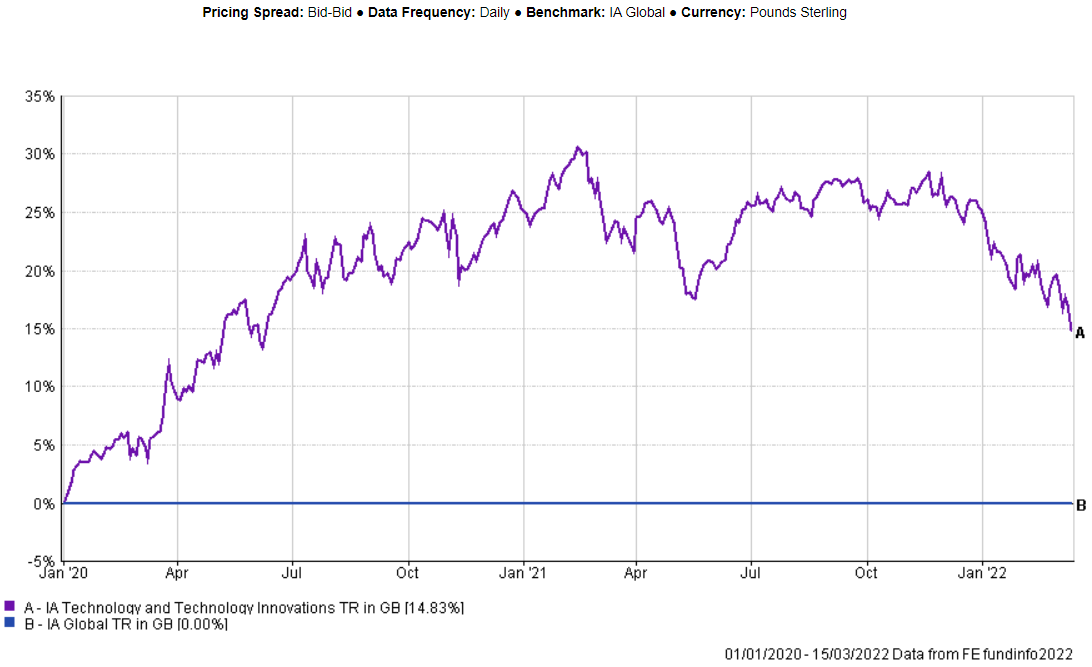

Whilst exposure in technology companies created outperformance in 2020 and 2021, the reverse has been true for 2022. The graph below shows performance since the 1 January 2020 of the Investment Association's technology sector, relative to the global sector. As you can see, whilst the outperformance was substantial in the last couple of years (above 25%), the relative underperformance this calendar year is almost 10%.

It is very difficult to predict whether inflation will start to reduce or whether a prolonged war in Ukraine and other issues could result in increased inflation rates for a much longer period.

If inflation rates do start to reduce, assuming their core business activities and profitability are unaffected within the technology sector, valuations are likely to increase again. However, this can be no means guaranteed.

Looking Forward

At Harding we believe in well diversified portfolios and use the expertise of a large number of investment managers across our portfolios.

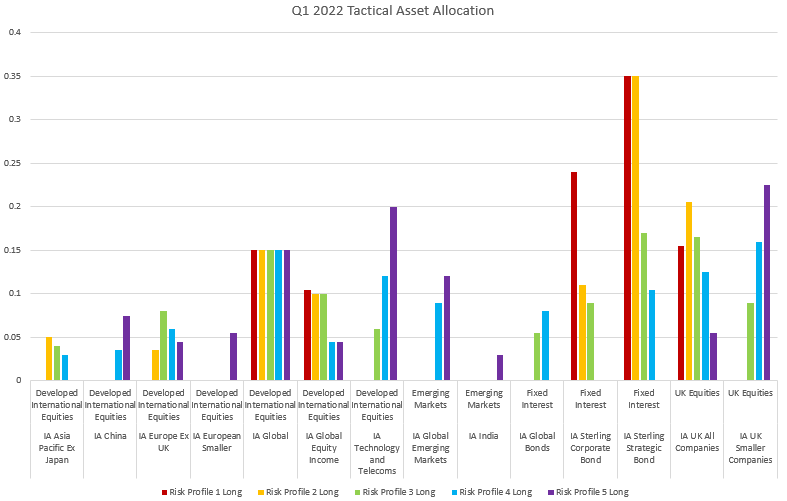

We continue to hold technology in our portfolios because we believe in the long term potential of these companies for the future. However, we now only allocate to this sector in our moderate to adventurous portfolios and due to the recent change in outlook, and the increased risk.

The chart below shows our 'asset allocation' for the different risk profiles advised by Harding for Q1 2022. As you can see, we are investing into 4 different asset classes (Developed International Equities, Emerging Markets, Fixed Interest and UK Equities), which are then diversified across 14 different sectors.

It is important to point out that whilst we have experienced some potentially short term volatility at the start of this year, clients are investing for the long term and should not be unduly concerned about short term fluctuations, however worrying it can feel at the time.

Whilst valuations might be lower than they were this time last year, the underlying holdings in the portfolio have strong prospects and the portfolios are invested in a wide range of asset classes, sectors, and funds to provide maximum diversification, which reduces risk to an appropriate level for your tolerance.

Whilst we cannot predict what will happen in the future with any certainty, many economic indicators such as unemployment rates, global growth and projected corporate profits are very positive, which should potentially point to a positive period of performance in the medium to long term.

If you have any questions about your portfolio or this article, please don't hesitate to contact your adviser.

1 https://www.investors.com/etfs...

Please note, the above article has been written based on our understanding of economic and market conditions over the period of time discussed and supports our investment ethos. Our investment ethos has strict aims, however it should be noted that markets are unpredictable and the value of your portfolio could go down as well as up. If you would like more details about out investment ethos please do not hesitate to contact us or ask your adviser.

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN