Continued Market Volatility

There is currently a lot of volatility in the financial markets and January has seen the FTSE100 drop by over 4.5% wiping billions of pounds off UK companies balance sheets

Continued Market Volatility

The financial markets continue to show increased volatility which has been present since August 2015.

Uncertainty of the market has been caused by a concern regarding the slowdown of China's growth and the reduction in commodity prices, particularly in the price of oil. This would indicate that there is less of a demand for oil in the global economy which would mean that global production is reduced and there is a risk that global growth may stagnate. It is not just the drop in demand but a glut exacerbated by Iran's recent re-entry into the supply chain whilst Saudi Arabia, the world's largest producer, has continued to maintain its supply level.

The reality however is that the developed market has become a lot less reliant on commodities such as oil in recent years due to the increase in usage of sustainable energies. The emerging markets however are still very much reliant on commodities.

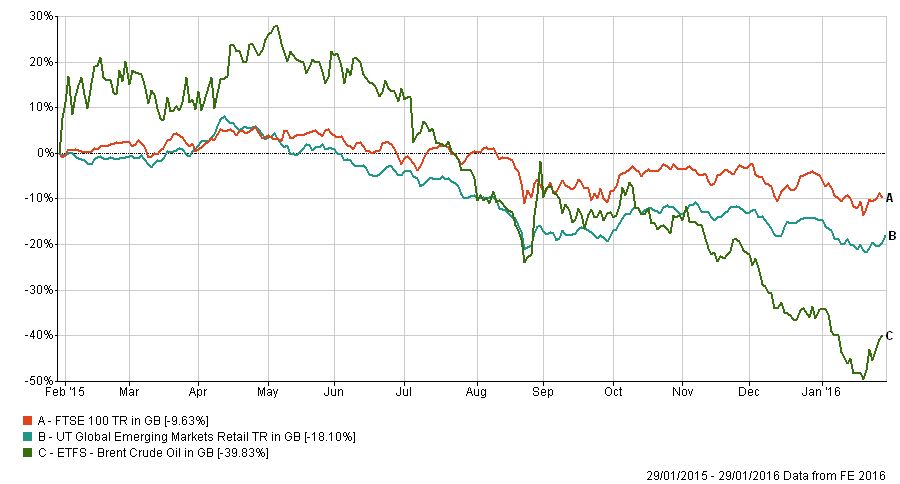

The graph below shows an Oil Price Index (Brent Crude Oil) against the Emerging Market sector and the FTSE 100 over the last 12 months.

As can be seen from this graph above the Brent Crude Oil Index has dropped by over 39%. The Emerging Market Sector has dropped by over 18% compared to the FTSE 100 which has dropped by over 9.5% over the same 12 month period.

Despite the drop in the developed markets over the last 12 months, the fundamentals are still incredibly strong. The UK's unemployment rate is the lowest it has been since the 'Credit Crisis' in 2008. Wage growth also rose considerably in the UK during 2015, averaging approximately 2.5% per annum despite consistently low inflation.

When the FTSE 100 falls like it has done in the last 12 months, it makes the front page of all the newspapers and can often be disconcerting to clients. It is however important to remember that the FTSE 100 is just one index of the UK economy and purely looks at the top 100 companies in the UK based on their market capitalisation. These top companies are traded across the world and are therefore dramatically affected by macro economic conditions whereas smaller companies in the UK are less affected by the global economy. With the strong UK fundamentals, this will typically be relayed into performance in these smaller enterprises.

Smaller companies in the UK are less affected by macro conditions in the global economy and therefore if the fundamentals in the UK are strong this will typically be relayed into performance in UK smaller companies.

The graph below shows the FTSE 100 against the UK Equity Income Sector and the UK Smaller Companies Sector over the same 12 months shown above.

As can be seen from the graph above, the UK Smaller Companies Sector (i.e. the average performance of funds that invest in UK Smaller Companies) has out performed by over 9% over the 12 months.

The UK Equity Income Sector is also shown on the graph above, which is the average performance of a fund that invests in typical large cap UK companies such as the FTSE 100. This shows that it is much more correlated to the FTSE 100 but has still had substantial outperformance with losses of only -2.89% rather than the FTSE 100 with losses of -9.63% over the same 12 month period.

This highlights that even within one asset class such as UK Equities, it is important to look for diversification within a client's portfolio and to invest accordingly.

As all our clients are aware, we look to invest their monies into a diverse portfolio of assets investing in line with their attitude to risk. This approach involves a number of asset classes such as Commercial Property, Fixed Interest, Absolute Return funds, Global Bond funds and Global Equity funds and not just UK Equities as outlined above. This ensures that even though clients' portfolios may be experiencing volatility at the moment, we aim to reduce losses during market downturns through diversification and to outperform when markets start to improve.

Call your adviser today to discuss your investment or pension portfolios and their current exposure to the markets.

Please note that past performance is not a guide to future performance and values can go down as well as up. This article does not constitute advice and no investment decisions should be made based on the information provided above. Please speak to your adviser before taking any actions.

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN