COVID-19: How is it affecting my investments?

Stock markets around the world have fallen for the seventh consecutive day. We wanted to discuss the impact that this may have on your portfolios.

COVID-19: How is it affecting my investments?

This time last year, not a day would go by without hearing about Brexit. We were one month away from Theresa May's Brexit deadline of the 29th March and the Prime Minister was desperately trying to get her Withdrawal Agreement through parliament. Today, things are very different; Brexit is rarely in the news headlines, which are now dominated by the Coronavirus.

Last week the S&P 500 fell 11.5%, and the FTSE100 fell 11.1%, largely due to fears of the Coronavirus. It is inevitable that the Coronavirus will have an effect on the markets and affected industries such as the travel sector are likely to experience the largest falls. Companies such as EasyJet, the cruise operator Carnival and Inter Continental Hotels Group have all fallen dramatically, as it is likely that their revenue will be lower due to reduced bookings, and their expenditure is likely to be higher based on having to accommodate additional expenses incurred by adapting to an ever-changing situation. However, sectors such as Technology and Healthcare have been doing well through this period of market turbulence. It is important to remember that during periods of volatility, investment opportunities present themselves which are important to capitalise on whilst also ensuring we mitigate risk as much as possible for our clients.

Active Management

The argument of 'active' versus 'passive' fund management is a constant and ongoing debate within the investment community. Active funds allow fund managers to buy and sell their holdings based on market conditions and specialised research, whereas passive funds are typically cheaper and simply track an index, such as the FTSE100 (the 100 biggest companies in the UK). During periods of low market volatility, passive funds tend to outperform because as markets gradually go up, active fund managers struggle to add value. Due to their low management costs, passive funds tend to outperform.

Our Investment Committee recommends moves between active and passive fund management depending on market conditions. Recently we have been in a period of high volatility, and the equity (stocks and shares) portions of our portfolios have been invested in active funds, in an effort to enhance the performance of your portfolios, however this can’t be guaranteed.

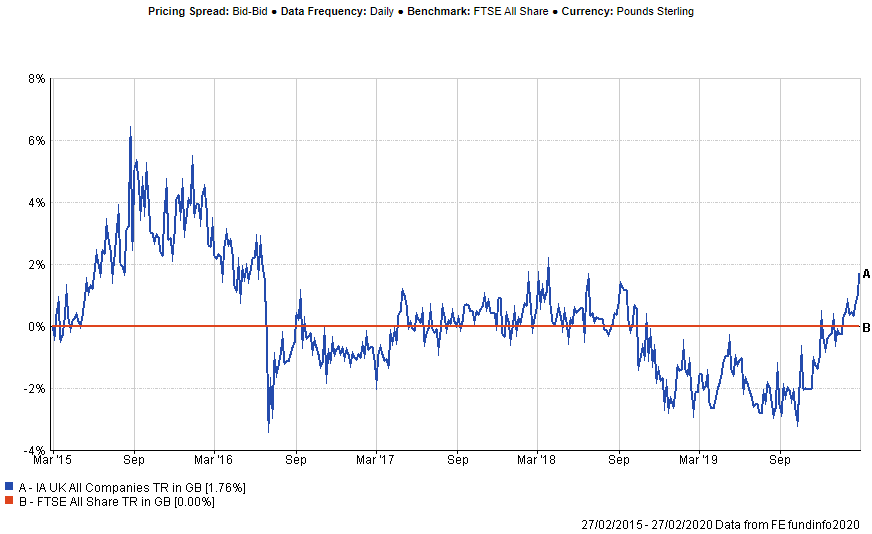

The graph below shows the performance of the UK All Companies Sector (a measure of UK equity active fund managers) in blue, relative to the FTSE All Share (in red) over the last 5 years. You will see that in the lead up to the Brexit vote in 2016, when there was a lot of market volatility due to the uncertainty of the vote, the UK All Companies Sector outperformed the FTSE All Share dramatically. Then in subsequent years of relatively low volatility, the UK All Companies Sector underperformed the FTSE All Share. However, recently, when Volatility has increased again in the markets, the UK All Companies Sector has started to outperform the FTSE All Share once again.

This shows the benefit that active fund management has for our clients when there is volatility in the markets.

Diversification

Our Investment Committee also ensures that our clients are invested in a well diversified portfolio across many asset classes, and are not over-exposed to the equity markets outlined above unless they have the suitable high risk tolerance to do so. At the time of writing, over the last month, whilst the UK Equity Income and UK All Companies Sectors are down -5.36% and -5.10% respectively, the Global Bond Sector and the UK Direct Property Sector are up 0.79% and 0.35%. Therefore, having this diversification across asset classes in our portfolios means that when the markets do fall, our portfolios tend not to fall as far as the markets in general, particularly for those taking less risk. Though this cannot be guaranteed.

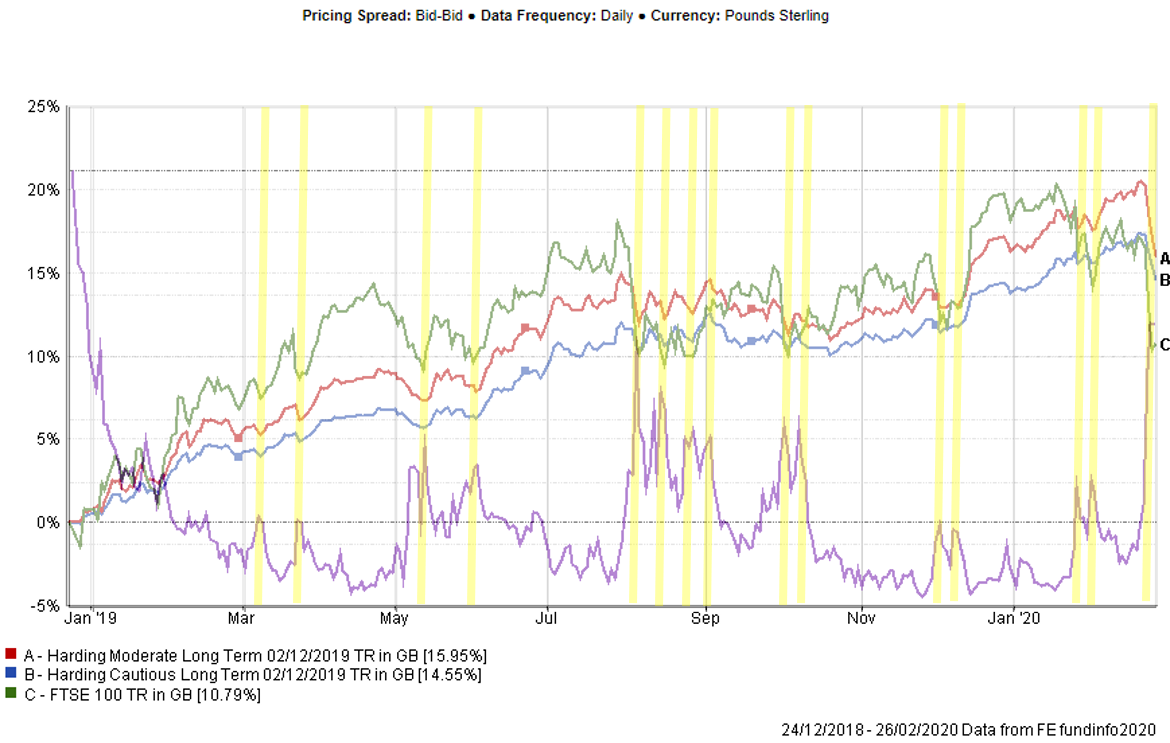

These two attributes, of having our equity exposure in active funds and diversification across asset classes, means that our portfolios tend to hold their value better in market downturns than the highly publicised equity indices such as the FTSE 100 and the S&P 500. The graph below shows the performance of our Moderate Long Term portfolio (red) and Cautious Long Term portfolio (blue) over the last 14 months, versus the FTSE100 (green). The VIX Index is also overlaid in purple, which is a measure of market volatility.

You can see from the graph above, as market volatility fell for the first 6 months of this chart, the FTSE 100 started outperforming our active portfolios. However, you will see that when there are sustained periods of market volatility (highlighted by the yellow bars), the FTSE 100 fell more sharply than our portfolios, and then our portfolios subsequently rebound quicker and tend to outperform. This is accentuated when the yellow bars occur more frequently (higher volatility). Please note that this is not a guide to future performance and funds can fall as well as rise.

Summary

We carry out extensive risk discussions with our clients to ensure that they are invested in the most suitable portfolio based on their tolerance, capacity and need to take risk. Our clients are also typically invested for the longer term, therefore it is important not to look too closely at short term market fluctuations. As hard as it might be to fight the urge to sell your investments during a downturn in the market, it is important to remember that in the main these funds are invested for your long term future. If you needed the money in the next 1-2 years, or even up to 5 years, the story may be different and you should contact us if you have any concerns in relation to a short term need for capital.

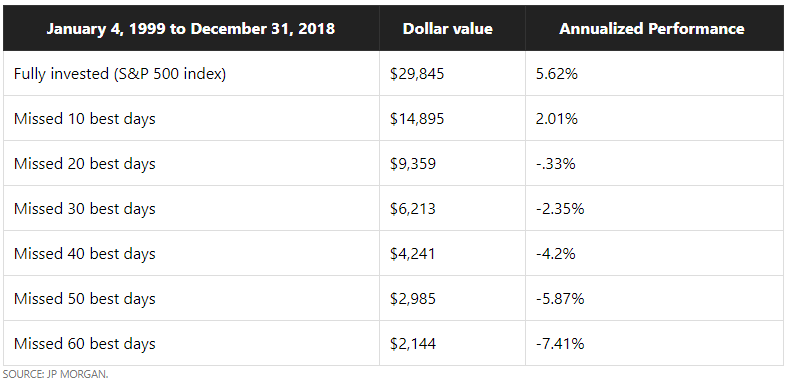

As can be seen from the graph above, short term falls in the markets have historically been followed by often swift recoveries. JP Morgan, a major US bank, did some research into the effect of investors coming out of the markets (selling to cash) following or during downturns, and then subsequently missing the recoveries. The table below shows that if someone had invested $10,000 in the S&P 500 over a 20 year period and remained invested for the whole period, they would have received a 5.62% average annual growth rate.

However, if the investor had sold out of the market and missed just the 10 best days over a 20 year period, they would have only achieved an annual rate of return of 2.01%. The more of the best days the investor missed, the worse their average annual performance gets. It is of course important to remember that this is historic data and no guarantee that future returns would follow the same route.

So in summary, it is never pleasant when investment markets fall in value, but it is important to remember the steps we take above and that investing is usually for the long term.

During an event like this, the following phrase is so important to remember: "it is not about timing the markets, it is about time in the markets".

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN