Brexit

The EU referendum is looming, voting seems to be close and no one knows what the outcome will be.....but what does it actually mean for our clients?

Brexit

Not a day passes without the word Brexit being uttered across all industries not least, the financial services industry. For many people, no matter how well informed, the decision of whether to leave the European Union or not is a very difficult decision to make. We have had many conversations with clients and fund managers over the last few weeks discussing how the Brexit vote could affect them personally and how such a vote could affect their finances. The following article is not designed to provide political opinion or to guide anyone how to vote, it is purely to discuss the financial implications of a Brexit vote on client’s portfolios.

Financial markets do not like uncertainty and uncertainty subsequently creates volatility. When dramatic unexpected events occur such as terrorist attacks or the recent oil price crash, the markets tend to react negatively. Typically, history shows that events such as elections, where the outcomes tend to be known, markets do not tend to react as aggressively as may have been originally anticipated. This is often due to the various outcomes being priced into the market prior to the event itself. The forecast by the National Institute of Economic and Social Research is that a Brexit may result in a 20% devaluation of the British Pound. The graph below shows that the British Pound has already devalued by approximately 10% against the US Dollar and the Euro over the last 12 months. Thereby showing that at least some of this projected devaluation seems to have already come to fruition.

Because of the up and coming uncertainty of Brexit, many companies and institutions, and even retail investors are holding off investing or putting their money to work, until they know the outcome of the vote on the 23rd June. One large sector starting to feel this pinch is the UK Commercial Property Sector. A couple of funds within this sector have started to see net outflows causing the fund managers to impose exit penalties on the funds in order to protect their assets and prevent them having to sell assets at a time when the markets are down, thereby again showing that the impending vote is already having a stark impact on the markets.

Vote to exit

As highlighted earlier, markets don’t like uncertainty and a Brexit will undoubtedly cause volatility in the markets for a few years to come until we understand what the future trade negotiations will look like between the UK and the rest of the world. The British Pound is likely to devalue on a Brexit even though a lot of this may already be priced in. If the British Pound does devalue as anticipated, even though this could be painful for the UK general public when booking holidays etc., this may result in an influx of foreign investment such as property purchases in London which could result in a rebound in property funds.

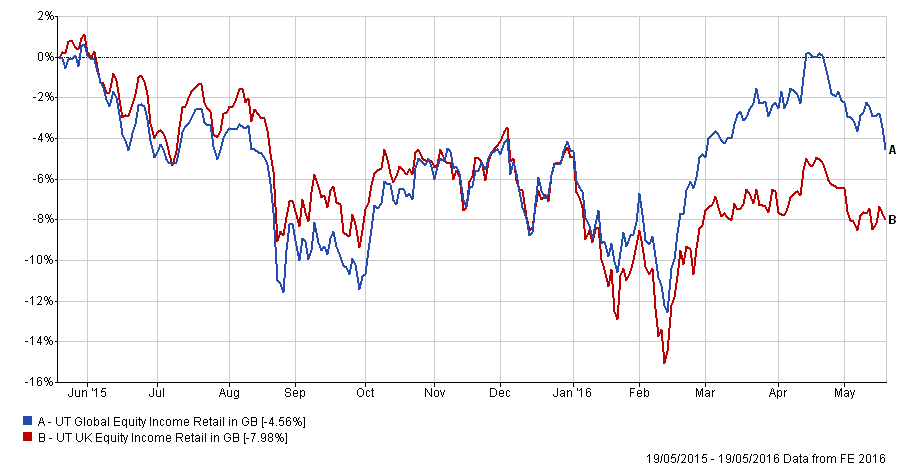

Global equities could also be impacted relative to UK equities, some Global Equities fund managers hedge against currency fluctuations however many do not. Funds that don’t hedge will be expected to provide greater returns with a weaker British Pound purely because of the exchange rate movement. The graph below shows the Global Equity Income sector against the UK Equity Income sector over the last 12 months.

As can be seen from the graph above, the Global Equity Income sector has decoupled from the UK Equity Income sector since February which is when the British Pound has seen the largest drop in value. This shows that a weak pound can increase the performance of Global Equities relative to the UK, despite other factors that would naturally result in out performance such as the rest of the world (other than Europe) not being affected by a Brexit as much as UK Equities.

Vote to Stay In

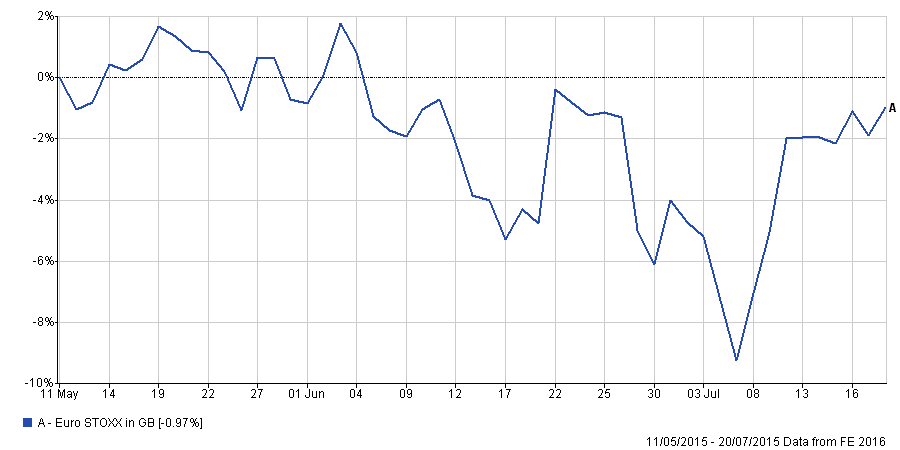

As we are currently members of the European Union a vote to stay in is deemed by a lot of people to be the ‘safe vote’. Many could see this as ‘business as usual’ and could see an influx of monies back into UK Equities and UK Property thereby resulting in a rally in these markets. European Equities would also be likely to rally as fears of a breakdown of the European Union would be laid to rest for the time being. The graph below shows the European STOXX 50 over the period last year when the Greek citizens voted against austerity and the European Stocks fell dramatically until a bailout agreement was reached and the stocks rebound quickly.

As can be seen from the graph above, the uncertainty of what would happen if Greece left the Euro caused a drop of over 8% within two months. As soon as these fears were laid to rest, the markets quickly bounced back.

Whichever way the vote goes, it shows that diversification within a portfolio is key at the moment. Holding a variety of asset classes with active fund managers and using funds such as Absolute Return funds within client's portfolios to hedge risk will be fundamental in helping to ride out the storm.

For more detailed information about your individual portfolio, please call your adviser on 01483 80 20 10.

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN