Harding Market Update - January 2019

With the financial markets experiencing increased volatility and with the uncertainty of Brexit, we have put together a summary of what is happening and how it may affect you.

Harding Market Update - January 2019

Brexit Overview

It is hard to go one day without hearing the dreaded word, ‘Brexit’. Since the UK voted on 23rd June 2016 to leave the European Union (EU), Theresa May has been in negotiations with its members to put together a withdrawal agreement on how the UK will leave the EU on the 29th March 2019.

The main features of the withdrawal agreement included: how much the UK would pay to the EU in order to break the agreement (approximately £39Bn), what would happen to EU citizens living in the UK and UK citizens living in the EU, agreeing a transitional period (up until 31st December 2020) and most controversially, the ‘Irish Backstop’. The UK and the EU are keen to ensure that the border between Northern Ireland and Ireland does not become a physical barrier with checkpoints and security posts (otherwise referred to as a ‘Hard Border’). The ‘Irish Backstop’ was put into the withdrawal agreement to ensure Northern Ireland could continue to follow some of the EU rules following the UK’s withdrawal, if a solution to preventing a Hard Border was not agreed.

The Irish Backstop has been an incredibly contentious sticking point with MPs. Despite Theresa May claiming it will never be used and an agreement will be reached, many MPs believe that this will become the fall-back position and Northern Ireland would continue to operate under some EU rules whilst the rest of the UK would no longer be a part of the EU.

MPs voted on Theresa May’s withdrawal agreement on Tuesday 15th January 2019 and they rejected Theresa May’s proposal by the most significant margin seen in government since 1918. This subsequently resulted in a vote of ‘no-confidence’ on the 16th January 2019. This vote allowed MPs to decide whether they still believe the current government is deemed fit to be in power, the result of which was 325 to 306 in favour of Theresa May’s government. The last no-confidence vote was ironically seen off by John Major in 1994 after a long battle over EU regulation.

It is fair to say that the UK is going through a significant time of uncertainty and the landscape is changing daily. Theresa May will now present a ‘Plan B’ on the 21st January and following this, there will be one of the following 6 outcomes for the UK:

- General Election – If two thirds of MPs are in agreement, a General Election could be called but this would have to be instigated by Theresa May and the earliest date for a General Election would be 25 working days after it was agreed. This would also require an extension to the 29th March withdrawal deadline.

- Second Referendum – A second referendum could be called which would almost certainly require an extension to the 29th March withdrawal deadline.

- Renegotiate – Theresa May would go back to the EU and renegotiate a new withdrawal agreement which could result in an extension to the 29th March deadline.

- Another Vote of No-Confidence – A vote of no-confidence could be instigated at any time by the Labour Party. If the government loses a vote of no-confidence, this could result in a General Election.

- Second Vote – Theresa May would seek to make minor changes with the EU and ask MPs to vote again on her existing deal.

- No Deal – If none of the above result in MPs coming to an agreement by the 29th March 2019, the UK will leave the EU without an agreement in place. There would be a transition period as outlined in the current withdrawal agreement, but this could inevitably result in several issues including the reintroduction of border checks, and transport links between the UK and EU could be affected amongst numerous others.

How does Brexit affect the markets?

Brexit has resulted in an incredible amount of uncertainty in the UK economy as no one quite knows whether MPs will come to an agreement, and how UK businesses will be affected if the UK does not have a deal with the EU as of 29th March 2019. An indicator of the global confidence in the UK is the value of the Pound. The graph below shows the value of the Pound (in red) in relation to the US Dollar (in blue) from the date of the referendum result, until today (17/01/19).

As you will see from the graph above, shortly after the result of the referendum, the Pound dropped in value by over 10% relative to the US Dollar. Up until March 2018, when the UK and the EU released statements saying they had agreed on several key issues, the Pound strengthened, highlighting an increasing confidence in the stability of the UK. However, since then and particularly since the withdrawal agreement was published in November 2018, there has been a gradual fall in the value of the Pound as it has become harder and harder for MPs to come to a consensus and agree on a withdrawal agreement. Over the last 12 months, this has resulted in a 6.67% decline in the Pound relative to the US Dollar.

Whilst a fall in the Pound indicates that global confidence in the UK is low, this can impact the economy both negatively and positively. Companies that export from the UK to the rest of the world will be competitively priced due to the low value of the Pound. It will also attract foreign investors and boost the tourism industry as their local currency would buy them more in the UK. However, the UK tends to spend more than double on importing goods over exporting goods. Therefore, for companies that are relying on importing goods from overseas, this could have an incredibly detrimental impact.

If we are unable to agree a deal with the EU there would be no transition period and it will create more uncertainty that is likely to impact the markets and could further devalue UK businesses. As can be seen from the graph below, The FTSE All Share has dropped 7.99% over the last 12 months.

How does Brexit affect my investments?

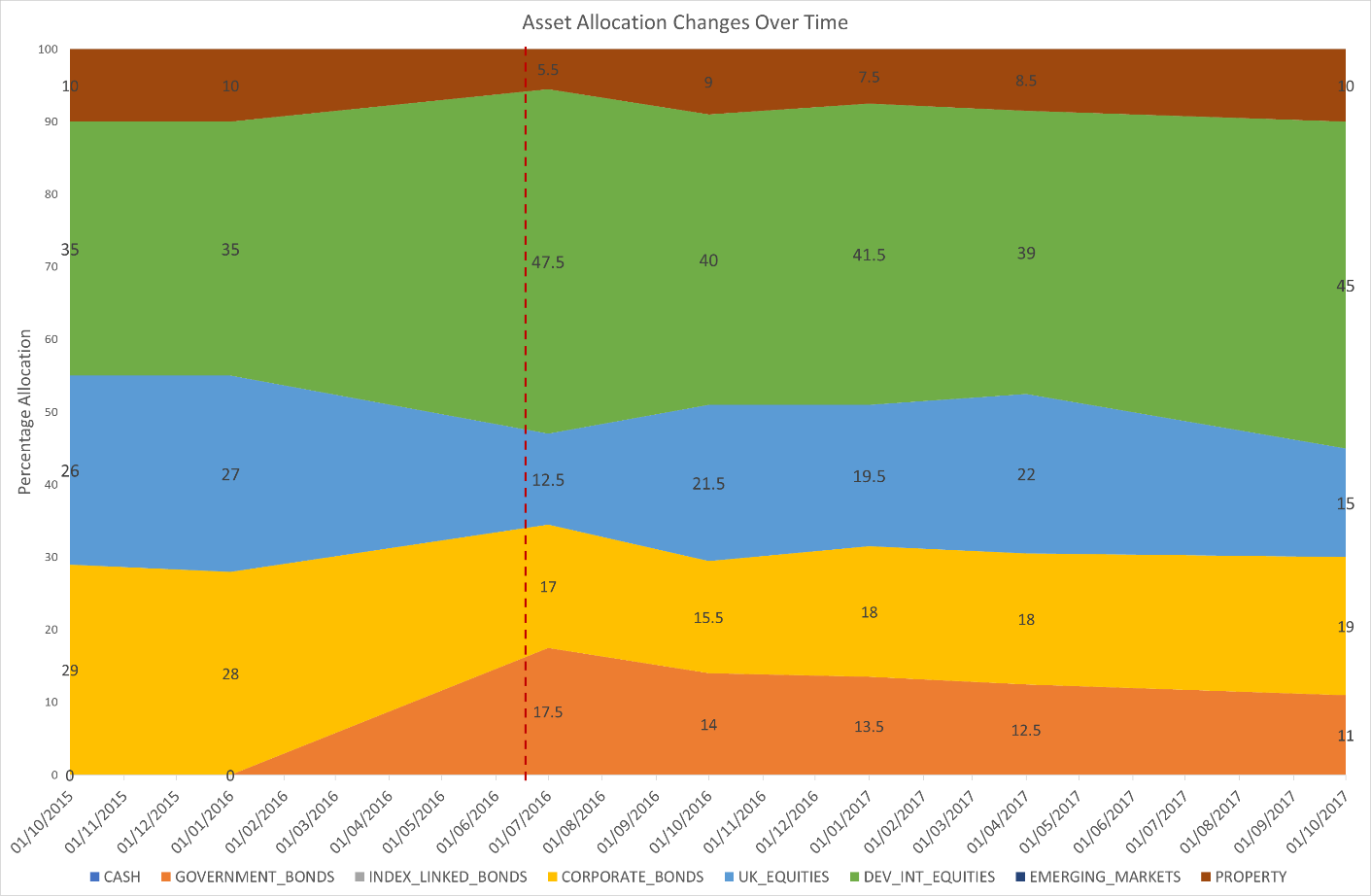

Since the referendum, there has been a dramatic shift away from UK Equities (stocks and shares) within our asset allocation model which we aim to target within our client’s portfolios. Below is a graph showing the change in the target asset allocation of a typical Moderate long-term portfolio. Prior to Brexit (highlighted by the Red dashed line below), there was approximately a 35% exposure to Developed International Equities and a 27% exposure to UK Equities. A year after the Brexit vote, these were 45% and 15% respectively thereby reducing our exposure to UK equities by 44% over the course of a year.

Brexit has had less of an impact on the portfolios due to these changes. If the Pound drops in value, as highlighted earlier, this would result in overseas assets becoming more valuable. However, all international markets have been volatile over the last 12 months because of factors other than Brexit.

What else has had an impact on my investments?

Over the last 12 months there have been several events which have caused uncertainty in the markets, other than the Brexit negotiations. The most notable have been the ‘Trade War’ between the US and China, the US Federal Reserve selling its Government Bond holdings and the US Government Shutdown. The graph below shows the performance of the S&P 500 in the US (Green), the MSCI World Index (Purple), the FTSE All Share in the UK (Red) and MSCI Emerging Markets (Emerging Markets) over the last 12 months.

As can be seen from the graph above, Emerging Markets are down approximately 9.03% over this time period as they are impacted significantly by the Trade Wars, due to their reliance on importing and exporting goods with the US & China. The FTSE All Share is down 7.99% due to the ongoing uncertainty of Brexit and the impact of other global events. The MSCI World index is down 1.88%, whilst the S&P was down approximately 6% at one stage, although it is currently up 2.32% over the last 12 months. This has partly been because the US Government is currently ‘shut down’ and has been for the longest period in history. The US Government Shutdown means that government services are currently frozen whilst ‘essential’ government staff are required to work without pay, and ‘non-essential’ government staff are sent home without pay. The Shutdown was caused because the Democrats refused to approve $5.7Bn of federal funding towards building the President’s border wall between the United States and Mexico.

Whilst the US Government Shutdown has played a part in causing further uncertainty in the markets over recent months, the US Federal Reserve tightening its Balance Sheet has had a greater impact on performance over the last 12 months. The US Federal Reserve (the US equivalent of the UK’s Bank of England) has been selling Government Bonds that were previously purchased to help the US economy, at a rate of $50Bn per month. They have also raised interest rates, which has resulted in less public borrowing and spending, thus causing the growth of the US economy to slow down. However, last month, Jerome Powell, Chairman of the US Federal Reserve, suggested they may stop raising interest rates as they had been previously; this was a contributing factor for the equity markets picking up towards the end of last year.

What should I do?

Volatility (the amount by which markets rise and fall) tends to go hand in hand with market downturns, however it allows active fund managers (which we tend to have a preference towards) to buy assets at a discount. When the markets fall, it allows the fund houses that we have carefully selected for you to invest with, to buy assets at a discounted value.

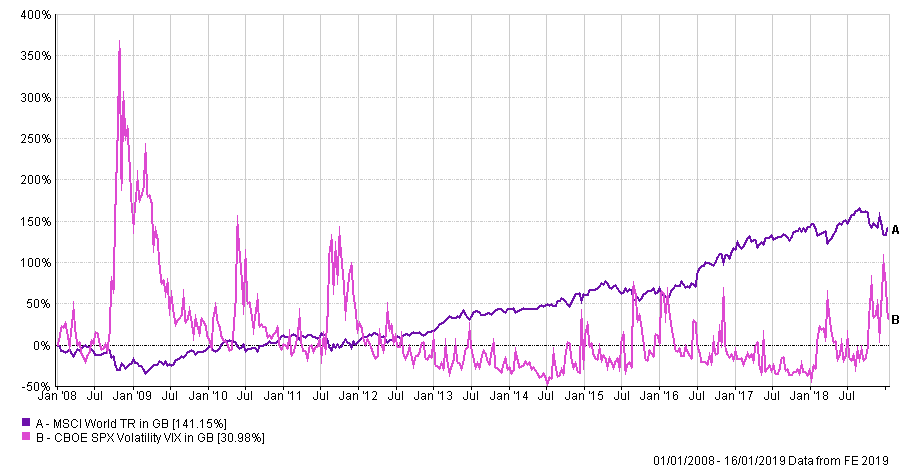

The graph below shows the performance of the VIX (which is an indicator of global volatility in Pink) and the MSCI World Index (which is an index of the largest 1,649 companies in the world in Purple) since the global financial crisis in 2008. As you will see below, we have had an incredibly low period of volatility for the last 6 years and whilst the markets tend to fall during periods of high volatility, these tend to be short lived.

When volatility is high and markets fall, it naturally brings a feeling of nervousness. However, it is important to remember the benefits of long term investing and that volatility is generally short lived – in other words, you should ride the storm and come out of the other side.

At Harding, we focus on creating a well-diversified portfolio for clients across many asset classes, to provide protection in times of uncertainty. We are always looking to invest for a timeframe which is appropriate for our clients, and it is therefore important to focus on this long-term picture. To this end, we are advising that there is no action for our clients to take in response to the rocky and ever-changing landscape of Brexit.

There will undoubtedly continue to be periods of high volatility, but you are investing over the longer term and we have positioned our portfolios to reflect this, considering the level of risk you were willing, able and needed to take. If you would like to talk to your adviser about any concerns you may have, please do not hesitate to contact them directly and they will be happy to discuss these with you.

Contact Us

Get in touch today

Call us, email, drop in, or fill in the form so that one of our expert advisers can be in touch.

We look forward to hearing from you and being your financial partner.

Guildford Office:

The Estate Yard

East Shalford Lane

Guildford

Surrey

GU4 8AE

London Office: c/o The Ministry, 79-81 Borough Rd, London, SE1 1DN